La vida está llena de imprevistos y FirstProtection está para cuidar de ti y los tuyos.

Un accidente o enfermedad puede poner en riesgo la estabilidad económica de tu familia. FirstProtection está contigo en todo momento, aún en los más difíciles.

No lo dejes para después.

¡Inscríbete hoy!

Detalles de la Cubierta

Los accidentes personales pueden ocurrir cuando menos lo esperas. Si sufres un accidente, FirstProtection te provee una compensación para mantener tu estabilidad y la de tu familia con beneficios por hospitalización, diagnóstico de enfermedades críticas, gastos finales, entre otros.

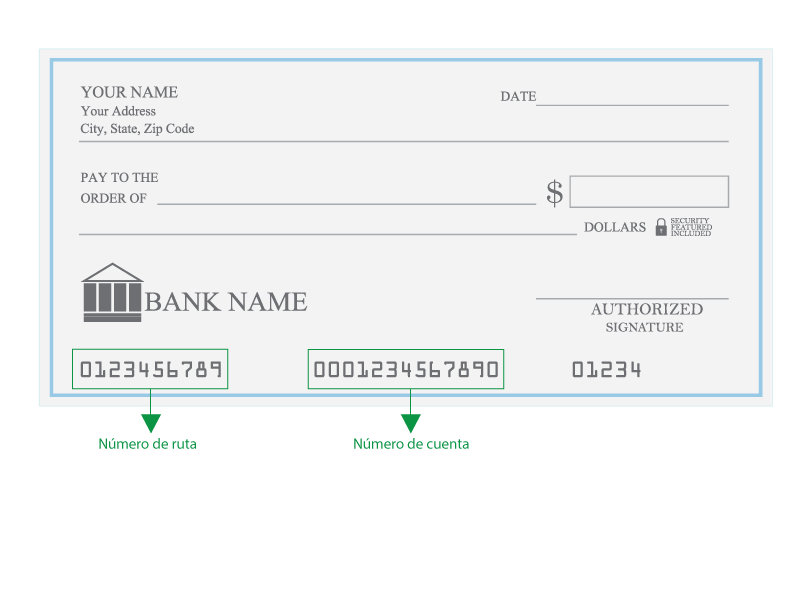

Para recibir los beneficios que ofrece esta cubierta, debes ser cliente de FirstBank y realizar el pago de la prima mensual utilizando la cuenta de depósito o tarjeta de crédito de tu preferencia.

ELEGIBILIDAD

Si estás entre las edades de 18 a 69 años, eres cliente de FirstBank y tienes una cuenta de depósito o tarjeta de crédito, este producto es para ti. Podrás continuar renovando el plan de protección hasta que cumplas 75 años.

Al momento de inscribirte, selecciona uno de los siguientes planes y descansa en el apoyo que te brinda FirstBank en momentos difíciles.

| CUBIERTAS | ||||||||

|---|---|---|---|---|---|---|---|---|

| $50 diarios (comenzando el 4to día) | $100 diarios (comenzando el 4to día) | |||||||

| ||||||||

| $50,000 | $75,000 | |||||||

| ||||||||

| $5,000 | $10,000 | |||||||

| ||||||||

| $3,500 | $5,000 | |||||||

| ||||||||

| $3,500 | $5,000 | |||||||

| ||||||||

FECHA DE EFECTIVIDAD

Queremos que disfrutes de la tranquilidad de estar cubierto lo antes posible.

Tu cubierta se activa el mismo día que te inscribes, una vez recolectado el primer pago mensual. El cargo se reflejará mensualmente en tu estado de cuenta del método de pago ingresado durante el proceso de inscripción a partir del mes de inscripción.

TIPO DE CUBIERTA

FirstProtection te ofrece una cubierta individual.

Esto significa que los beneficios cubiertos aplican solo a la persona que adquiera la póliza y a los beneficiarios designados por esta.

Para más información sobre FirstProtection, refiérete al certificado de seguro.