Life is full of unexpected events and FirstProtection takes care of you and your loved ones.

An accident or illness can put your family's financial stability at risk. FirstProtection is with you at all times, even in the most difficult ones.

Don’t miss another day.

Enroll today!

Coverage Details

Personal accidents can happen when you least expect it. If you suffer an accident, FirstProtection provides you with compensation to maintain your stability and that of your family with benefits for hospitalization, critical illness diagnosis, final expenses, among others.

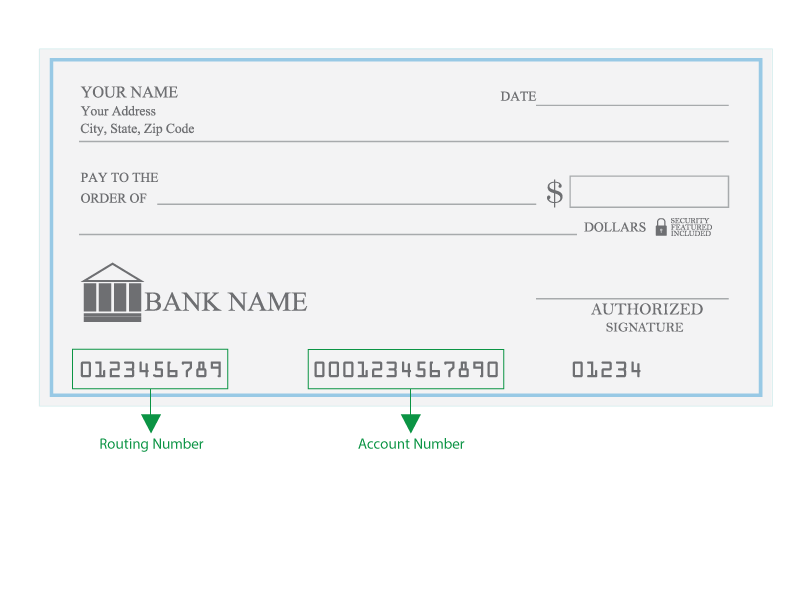

To receive these benefits, you must be a FirstBank customer and make your monthly premium payment using the deposit account or credit card of your choice.

ELIGIBILITY

If you are between the ages of 18 and 69, you are a FirstBank customer and have a deposit or credit card account, this product is for you. You can continue renewing your protection plan until you turn 75 years old.

When you sign up, select one of the following plans and rest in the support that FirstBank provides you during difficult times.

| COVERAGE | ||||||||

|---|---|---|---|---|---|---|---|---|

| $50 daily (starting on day 4) | $100 daily (starting on day 4) | |||||||

| ||||||||

| $50,000 | $75,000 | |||||||

| ||||||||

| $5,000 | $10,000 | |||||||

| ||||||||

| $3,500 | $5,000 | |||||||

| ||||||||

| $3,500 | $5,000 | |||||||

| ||||||||

EFFECTIVE DATE

Enjoy the peace of mind of being covered right away.

Your coverage begins on the same day you enroll, as soon as your first monthly payment is successfully processed. The charge will appear monthly on the statement for the payment method you provided during enrollment, starting in your enrollment month.

TYPE OF COVERAGE

FirstProtection offers you an individual coverage.

This means that the covered benefits apply only to the person who purchases the policy and the beneficiaries designated.

For more information about FirstProtection, refer to the program certificate of insurance.